ATHENS — Former legislator and town supervisor Lee Palmateer said Wednesday he filed an Article 78 petition with state Supreme Court in Ulster County seeking nullification of the Greene County Industrial Development Agency’s approval of an application by New Athens Generating Company for a tax break.

“This case is about the Greene County Industrial Development Agency trading the interests of the public for the enrichment of itself and its paying client,” Palmateer said in court papers. “[The IDA] stood to reap a $332,000 ‘transaction fee’ and 20 annual ‘monetized power payments’ of up to $285,714 each from [Athens Gen] contingent upon approval of the application.”

Palmateer is seeking placement of the power plant property on the tax rolls, a formal appraisal of the property by the Town of Athens, remediation under the Greene County Code of Ethics, allocation of all monetized power payments to the Town of Athens and annulment of the IDA’s approval of the tax break application.

Also named as respondents in the petition are New Athens Generating Company, Greene County, Catskill Central School District and Town of Athens.

The petition alleges the IDA approved Athens Gen’s application without financial data or property appraisal and alleges the Town of Athens reduced the assessed value of Athens Gen’s power plant properties from $1.24 billion to $346 million without an appraisal, according to court papers.

“[The IDA] attacked and interfered with the Town of Athens’ authority to assess the power plant property values,” Palmateer said in court papers.

IDA counsel Paul Goldman said Wednesday he has not been served with the petition and has not seen it.

“It’s difficult to comment on a document without having seen any of it,” Goldman said. “I’ll have further comment when we’re served with the papers.”

Palmateer said New Athens Generating Company contemplated performing ambiguously defined power plant maintenance and inspection work costing about $33.2 million over five years — an average of about $6 million per year.

“That relatively small investment opened the door for [the IDA] to exempt the entire power plant value for 20 years and extend its lucrative relationship with NAGC that was about to expire,” Palmateer said.

On Sept. 15, 2022, New Athens Generating Company submitted its application for a tax break to the IDA. Athens Gen sought another 20 years of property tax exemptions on top of the 20-year agreement it had, according to court papers. Athens Gen’s stated grounds were that without financial assistance, “the needed investments are unlikely to be made and the plant may be sent into another bankruptcy...or possible closure.”

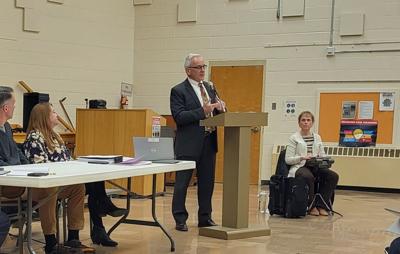

Six months later, on March 29, the IDA held a public hearing before a packed house at E.J. Arthur Elementary School in Athens about the proposed tax break. Characterizing the IDA’s tone in the court papers as contemptuous and arrogant, Palmateer said the IDA said nothing to the audience about the proposal and made no attempt to explain the basis for approving the application.

“The public sentiment expressed at the hearing was overwhelmingly opposed to the financial assistance,” Palmateer said in court papers, adding that several former Athens village mayors and town supervisors spoke out in opposition.

Palmateer noted weaknesses in the IDA’s substantive review. He said the IDA failed to require Athens Gen to submit supporting documents needed to evaluate its financial health, failed to investigate the accuracy of representations made by Athens Gen in the application, and the IDA’s failure to obtain plans, specifications, drawings and any other documentation defining the scope of the proposal.