ATHENS– In November, former legislator and town supervisor Lee Palmateer filed an Article 78 petition with state Supreme Court in Ulster County seeking nullification of the Greene County Industrial Development Agency’s approval of an application by New Athens Generating Company for a tax break.

On Feb. 15, that petition was dismissed by an Ulster County judge.

The original petition to the Supreme Court in Ulster County said the case was about the Greene County Industrial Development Agency trading interests of the public to better themselves and its paying client.

Also named as respondents in the petition are New Athens Generating Company, Greene County, Catskill Central School District and Town of Athens.

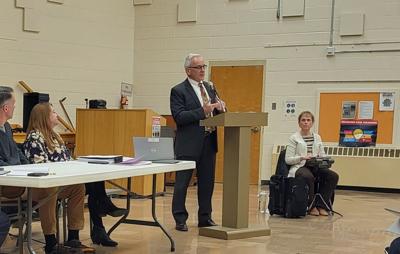

On Sept. 15, 2022, New Athens Generating Company submitted its application for a tax break to the IDA. Six months later, on March 29, the IDA held a public hearing before a packed house at E.J. Arthur Elementary School in Athens about the proposed tax break.

“The GCIDA stood to reap a $332,000 ‘transaction fee’ and 20 annual ‘monetized power payments’ of up to $285,714 each from [Athens Gen] contingent upon approval of the application,” Palmateer said in court papers.

Palmateer said he brought the action because he was uniquely injured.

According to the petition, “his (Palmateer) property tax burden is increased, which is uniquely compared to the vast majority of County residents who do not live in the town of Athens. GCIDA attacked and interfered with the town of Athens authority to assess the power plant property values. As a resident of the town, petitioner’s right to democratically elected representation on town matters has been infringed, which is unique injury relative to the rest of the county.”

However, the court said Palmateer failed to demonstrate that he suffered injury.

“The Court did not reach the merits of my claims, namely that the tax exemptions were improper,” Palmateer said in a statement. “I commend the Court and Judge Gandin for issuing a prompt decision. I have complete respect for the Court and see the wisdom of not spending judicial resources on the merits, having first concluded that I lacked standing.”

The court documents said, “Petitioner’s [Palmateer] contention that he is harmed by the PILOT (payment in lieu of taxes) agreement because he will incur higher taxes to offset the resulting loss of annual property tax revenue to the town does not constitute an injury,” according to court documents. “The Petitioner’s (Palmateer) assertion that he has standing based on his common law taxpayer status also lacks merit.”

Palmateer’s challenge to the town’s assessment of Athens Gen property by virtue of his status, fails for lack of demonstrable injury, according to court documents.

Palmateer disagrees with the court’s finding that he lacked standing without special damage, he said.

“I believe the law recognizes standing in matters of appreciable public significance if failure to accord standing would effectively erect an impenetrable barrier to judicial scrutiny,” he said. “That is the case here. Athens Gen’s property may be worth more than the entire balance of the Town of Athens. The effects on property taxes are of enormous public significance. The municipalities lost standing by cooperating with the IDA. No one else has special damages. Therefore, the IDA effectively can run afoul of the law with judicial immunity, and the other taxpayers who suffer the consequences can only grin and bear it.”

An appeal is under consideration, but not has been filed.

“If standing is found after an appeal, the needed judicial scrutiny will be had,” Palmateer said. “I believe that is what’s required.”